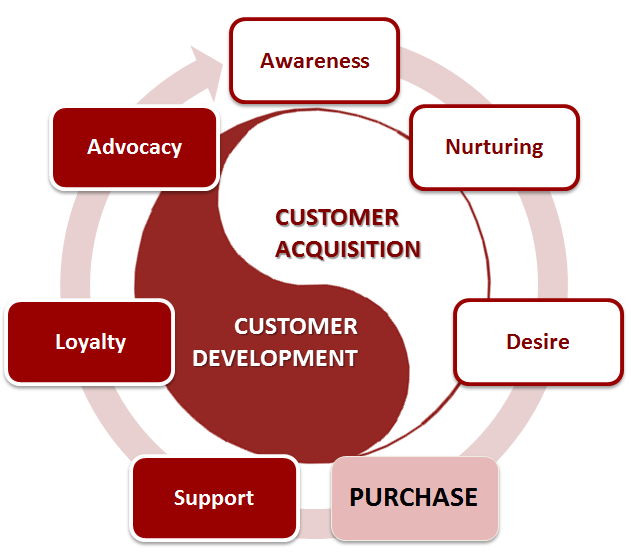

Customer Engagement anchors the sales system and defines the processes and methodologies used to engage customers and close business.

Following is an example of Customer Engagement, It’s a little farfetched, but I think you will get the picture.

Customer Engagement Outline

We are offering to sell you a $50.00 for just $25.00.

Skeptical? You may have a few questions.

- Are the $50 notes genuine, or are they forgeries?

- Are there any conditions?

- How many can I purchase?

- Is this a scam?

That’s a good start, but I am sure you would think of a lot more before actually spending $25.

But let’s say, just for argument’s sake, the offer was 100% genuine, but you wanted to be sure, so you asked, “Can I just buy one $50 note and come back later and buy more?”

This offer is too good to be true. Do you think I will come back and buy more if I take the $50 to the bank and they authenticate it as genuine?

But wait a minute. The first $50 would always be genuine if it’s a scam. That’s how scams work.

However, the offer is for a one-time purchase per customer.

Come on Now!

Is the offer genuine? It would play on your mind, wouldn’t it? No matter how far you take it, you will always think, “What If?”

For most of my career, I managed a team of salespeople who sold Capital Equipment. Our Customer Engagement centred on offering prospective customers substantial savings on any investment they made in our solutions.

No, it wasn’t a scam. It’s called ROI (return on investment) or payback period, and because of our Customer Engagement approach, the prospect had to confirm the savings before we offered the solution.

Imagine the confidence any salesperson would have, knowing that the financial outcome would, nine times out of ten, deliver a payback period of under 12 months.

Two Real Life Examples

A supermarket chain in Australia, because of its flawed accounts payable processing methodology, paid numerous suppliers twice for the same invoice, with total overpayments identified as $2.7 Million.

Staff in a large, well-known general insurance company misfiled just three policy files identified on the one day our team spent with them. They had an extremely large and complex manual filing system and, under discovery, admitted to recreating the files and forging signatures.

Without a copy of the policy file, they could not examine the legitimacy of the claim and would have been forced to pay 100% of the claim.

In fairness, the General Manager did not know his staff was in the habit of doing this and unleashed a verbal tirade on the staff when he found out.

The value of the claims against these three insurance policies was $1.3 Million.

No matter how effective our Customer Engagement offer was, the sales process required the salesperson to gain commitment from key decision-makers on seven key points before being in a position to close the business.

We needed to fine-tune several skills the salespeople used in our engagement, which were the stepping stones to any of the conversion ratios measured and reported by software products like CRM.

No software can measure or suggest how to improve these stepping stones; they had to be observed during each customer engagement and coached to improve.

We called them Micro Selling Skills!

Our best year-on-year result was 180% over the previous year. While our customer engagement strategy contributed significantly to that achievement, our attention to the minor selling improvements our sales team could coach was also significant.

Over 30% of our success was due to the coaching philosophy we used to improve the selling skills of each member of the sales team.

Customer Engagement strategies change, and with that change, you will always see fluctuations in forecast achievement.

However, improvements in the small selling skills we call Micro Selling Skills last forever because they become habits that tune salespeople into sales champions and a champion sales team.